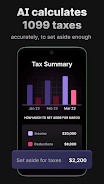

Key App Features:

-

AI-Driven Deduction Discovery: FlyFin's AI automatically identifies all eligible tax deductions, including car mileage, home office expenses, and business meals, minimizing your tax burden and saving you valuable time.

-

Smart Tax Savings Planning: The app monitors your income, expenses, and deductions to calculate the optimal monthly tax savings amount, guaranteeing you're prepared for tax season without unexpected costs.

-

Free Resources & Calculators: Access helpful tools like a 1099 tax calculator, quarterly tax calculator, free CPA webinars, and comprehensive tax guides – all designed to reduce tax-related stress and provide expert guidance.

-

Automated Bookkeeping: Automate your financial record-keeping. FlyFin tracks your expenses on the go, reducing your tax filing workload by 95%, freeing up your time and energy.

-

CPA-Managed Federal & State 1099 Filings: Our team of experienced CPAs meticulously reviews, prepares, and files your tax returns, guaranteeing the highest possible refund and providing comprehensive audit insurance for your peace of mind.

-

Unmatched CPA Support: Benefit from unlimited access to our CPAs with over 100 years of collective experience. Get expert assistance and answers to all your tax questions whenever you need them.

In Conclusion:

FlyFin is the ultimate tax solution for freelancers and the self-employed. Its sophisticated AI technology effortlessly maximizes tax deductions, saving you both time and money. Combined with user-friendly tools, automated bookkeeping, and the support of experienced CPAs, FlyFin ensures accurate filings, maximized refunds, and complete financial control. Download FlyFin now and experience the future of tax preparation! We prioritize data privacy and employ state-of-the-art security measures to protect your information.

Screenshot