Introducing VAT East, the ultimate app designed to empower consumers, taxpayers, tax officials, and procuring entities. With VAT East, you can effortlessly verify the authenticity of a VAT registration number, known as BIN or eBIN. This empowers you to assess the trustworthiness and risk associated with a business before engaging in any transactions.

Beyond verification, VAT East fosters transparency and accountability by enabling users to lodge complaints against taxpayers. This ensures that tax officials receive valuable feedback and can take appropriate action against any potential tax evasion.

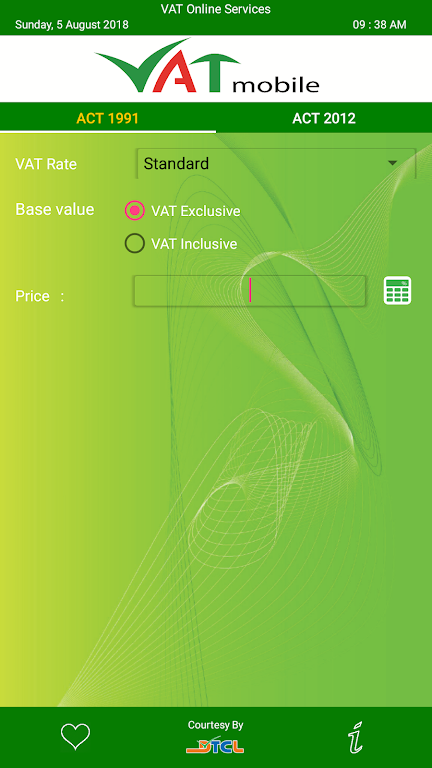

VAT East simplifies your VAT journey by providing convenient access to essential information and services:

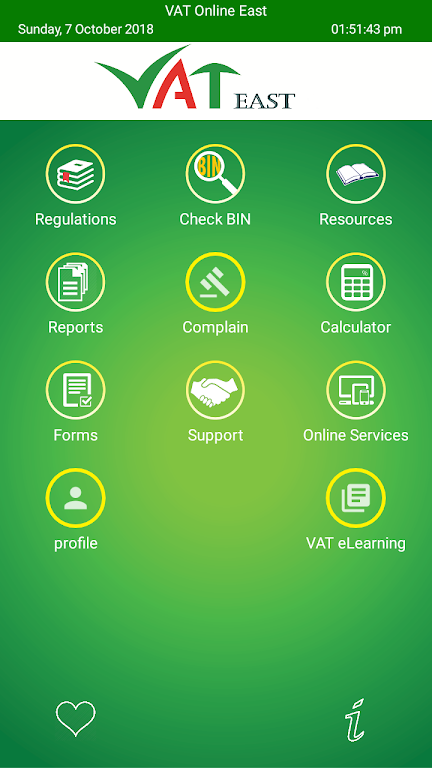

Features of VAT East:

- BIN Check: Verify the authenticity and status of a VAT registration number to determine the trustworthiness of a taxpayer before engaging in business.

- Complaint Lodging: Consumers can lodge complaints against taxpayers, providing tax officials with valuable feedback and ensuring the authenticity of tax evasion information. Users may also be rewarded for providing accurate information.

- Find VAT Office: Locate the nearest VAT office under Dhaka East VAT Commissionerate with ease, complete with directions.

- Compliance Alert: Receive timely reminders through notifications and mobile SMS to ensure you never miss a deadline for submitting your monthly VAT Return or Quarterly ToT Return.

- Compliance Acknowledgement: Receive acknowledgement notifications and special thanks from the Commissioner for submitting your VAT or Turnover Tax return.

- VAT Consultant, Agent, and ADR: Access a comprehensive list of active VAT Consultants, Agents, and ADR (Alternative Dispute Resolution) options, allowing you to easily connect with professionals for assistance.

Conclusion:

VAT East is your comprehensive solution for all VAT-related needs. Download the app today and streamline your VAT processes and interactions.

Screenshot

XCOEX是我用过的最好的加密货币钱包,界面友好,安全性高,买卖和兑换都很方便,强烈推荐给所有加密货币用户!

Una aplicación útil para verificar los números de registro de IVA. Es fácil de usar y proporciona resultados rápidos.

Application pratique pour vérifier les numéros d'enregistrement TVA. Simple d'utilisation, mais manque de fonctionnalités.